By Denise Calder December 15, 2025

Accounts receivable has traditionally been one of the slowest moving parts of business operations. For decades, paper invoices, mailed checks, and manual follow ups were considered normal. While this approach worked in the past, it no longer fits the speed and expectations of modern business. Customers today expect convenience, transparency, and fast digital interactions across every touchpoint. As a result, AR modernization is becoming essential rather than optional. Moving from paper based billing to click to pay links and ACH payments allows businesses to collect faster, reduce errors, and improve cash flow without increasing administrative workload.

AR modernization is not just about replacing checks with digital payments. It involves rethinking how billing, payment acceptance, reconciliation, and customer communication work together as a single system. Integrated payments play a central role in this shift by connecting invoicing, accounting, and payment acceptance into one streamlined process. When businesses modernize AR properly, they reduce days sales outstanding, improve customer satisfaction, and gain better visibility into their financial health. This transformation is especially important for growing businesses that need predictable cash flow to support expansion, hiring, and operational investments.

The Limitations of Paper Invoices in a Digital Economy

Paper invoices slow down every part of the receivables cycle. Printing, mailing, delivery delays, and manual processing all add friction between service delivery and payment collection. Even when customers intend to pay on time, paper invoices can be misplaced, forgotten, or delayed in internal approval workflows. These inefficiencies increase days sales outstanding and create unnecessary follow up work for finance teams. In today’s digital economy, such delays are no longer acceptable or competitive.

Paper invoicing also limits visibility. Finance teams lack real time insight into invoice status, making it difficult to forecast cash flow accurately. Manual data entry introduces errors that lead to disputes, further delaying payment. As businesses scale, these issues compound quickly. AR modernization addresses these limitations by replacing paper processes with digital workflows that move at the pace of modern commerce while improving accuracy and accountability.

How Click-to-Pay Changes Customer Payment Behavior

Click to pay options simplify the payment experience for customers by removing unnecessary steps. Instead of receiving a paper invoice and writing a check, customers receive a digital invoice with a secure payment link. With one click, they can pay using card or bank transfer without logging into separate systems or handling paperwork. This convenience significantly increases the likelihood of faster payment and reduces friction in the payment process.

From a behavioral perspective, click to pay removes barriers that often cause payment delays. Customers are more likely to act immediately when payment is easy and intuitive. Integrated payments ensure that once a payment is made, it is automatically recorded against the invoice, reducing reconciliation work. Businesses that adopt click to pay experience improved cash flow and fewer follow ups because payment becomes part of the customer experience rather than a separate administrative task.

The Role of ACH in Modern AR Workflows

ACH payments are a cornerstone of AR modernization, particularly for B2B transactions and recurring invoices. Compared to credit cards, ACH offers lower processing costs and greater suitability for high value payments. When combined with click to pay functionality, ACH allows customers to authorize payments directly from their bank accounts without manual intervention. This reduces reliance on checks while maintaining cost efficiency.

Integrating ACH into AR workflows also improves predictability. Businesses can set up recurring billing or scheduled payments, reducing uncertainty around collection timing. Payment gateway technology enables secure ACH processing while maintaining compliance and data protection standards. For businesses transitioning away from paper checks, ACH offers a practical bridge that aligns with modern expectations while preserving financial control.

Why Integrated Payments Are Central to AR Modernization

Integrated payments bring invoicing, payment acceptance, and accounting into a unified workflow. Instead of managing separate systems for billing and collections, businesses can automate the entire AR process. When an invoice is generated, payment options are embedded directly into the document. Once the customer pays, the transaction is automatically recorded and reconciled. This level of integration eliminates manual data entry and reduces errors.

The power of integrated payments lies in visibility and efficiency. Finance teams gain real time insight into outstanding invoices, partial payments, and completed transactions. This makes forecasting more accurate and decision making faster. Integrated payments also improve the customer experience by offering consistent, easy to use payment options across channels. As businesses modernize AR, integration becomes the foundation that supports scalability and long term efficiency.

Choosing the Right Payment Gateway for AR Transformation

The payment gateway acts as the technical link between invoices, customer payment methods, and banking systems. For AR modernization, the gateway must support both card payments and ACH while integrating seamlessly with invoicing and accounting software. A robust payment gateway ensures secure transactions, fast authorization, and reliable settlement without disrupting workflows.

Beyond basic functionality, the payment gateway must support automation and data synchronization. It should work smoothly with integrated payments and provide clear reporting for reconciliation. Choosing the right payment gateway is critical because it determines how easily a business can scale digital billing and adapt to future payment innovations. A poorly chosen gateway can limit automation and create bottlenecks that undermine the benefits of AR modernization.

How Payment API Connections Enable Seamless Automation

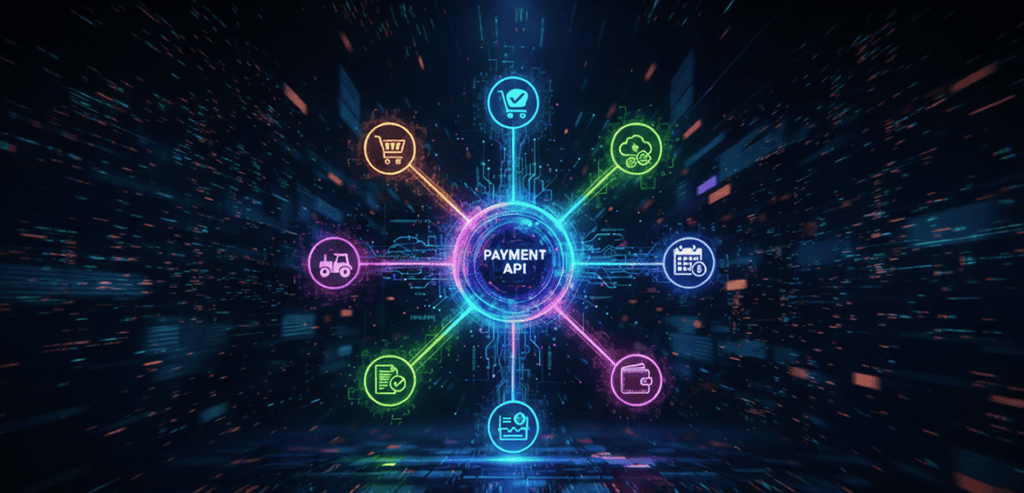

A payment API allows different systems to communicate with each other in real time. In AR modernization, payment API connections enable invoices, payment gateways, and accounting platforms to exchange data automatically. This eliminates the need for manual uploads or batch processing. When a customer clicks to pay, the payment API transmits transaction details instantly, updating invoice status and ledger entries.

Payment API driven automation reduces delays and errors while improving transparency. Finance teams no longer need to reconcile payments manually because data flows seamlessly between systems. This automation also supports scalability, allowing businesses to handle higher invoice volumes without increasing administrative workload. As AR processes become more digital, payment API connections become essential infrastructure rather than optional enhancements.

The Role of POS Systems in AR Modernization

While AR is often associated with invoicing rather than point of sale transactions, POS systems still play an important role in certain business models. Companies that combine in person sales with invoicing need POS systems that integrate smoothly with backend AR workflows. Modern POS systems can capture transaction data and feed it into integrated payments platforms, ensuring consistency across sales channels.

POS systems that support integration reduce data silos and improve reporting accuracy. When in person payments and invoice based payments flow through the same payment gateway and accounting system, businesses gain a unified view of receivables. This alignment supports better cash flow management and reduces reconciliation complexity. POS systems are no longer isolated tools but part of the broader AR modernization strategy.

Using Clover POS in Hybrid AR Environments

Clover POS is widely used in retail and service environments, but it can also support hybrid AR workflows when properly integrated. In businesses that accept both immediate payments and invoice based payments, Clover POS can serve as the front end for transactions while backend systems handle AR tracking. Integration ensures that payments processed through Clover POS are reflected accurately in receivables records.

When connected through a payment gateway and payment API, Clover POS becomes part of an integrated payments ecosystem. This allows businesses to offer consistent payment options regardless of how the transaction originates. For companies modernizing AR, Clover POS can support the transition by bridging in person and digital payment experiences without fragmenting data.

Leveraging Genius POS for Advanced Payment Integration

Genius POS is designed with integration and flexibility in mind, making it well suited for businesses modernizing their AR processes. Its ability to connect with invoicing systems and payment gateways allows transaction data to flow seamlessly into AR workflows. This is particularly useful for businesses that need detailed reporting and automated reconciliation.

By using Genius POS alongside integrated payments, businesses can ensure that both POS transactions and click to pay invoice payments are captured consistently. Payment API connections allow real time updates across systems, reducing delays and discrepancies. Genius POS supports a modern AR strategy by aligning front end payment acceptance with backend financial processes.

Reducing Days Sales Outstanding Through Digital AR

One of the most measurable benefits of AR modernization is the reduction in days sales outstanding. Faster payment options such as click to pay and ACH shorten the gap between invoicing and collection. When customers receive digital invoices with immediate payment options, they are more likely to pay promptly. Automated reminders further improve collection rates without requiring manual follow up.

Integrated payments ensure that once payment is made, it is immediately reflected in AR records. This reduces delays caused by manual posting or check clearing. Over time, reduced days sales outstanding improves cash flow predictability and strengthens financial stability. For growing businesses, this improvement can free up capital that would otherwise be tied up in unpaid invoices.

Improving Customer Relationships Through Payment Convenience

AR modernization is not just an internal efficiency initiative. It also improves customer relationships by making payments easier and more transparent. Customers appreciate clear digital invoices, flexible payment options, and confirmation of receipt. Click to pay reduces frustration and positions the business as professional and easy to work with.

When businesses offer ACH and card payments through integrated payments systems, they accommodate different customer preferences. This flexibility reduces disputes and delays caused by payment friction. Modern AR practices demonstrate respect for the customer’s time and processes, strengthening trust and encouraging long term relationships.

Enhancing Security and Compliance in Digital AR

Security is a critical consideration in AR modernization. Digital payments must be processed securely to protect sensitive customer data and maintain regulatory compliance. Payment gateway technology and payment API connections provide encryption, tokenization, and compliance controls that are difficult to achieve with paper based processes.

By reducing reliance on mailed checks and manual data entry, businesses also reduce exposure to fraud and human error. Integrated payments centralize security controls and make monitoring easier. AR modernization improves not only efficiency but also risk management by replacing outdated methods with secure digital infrastructure.

Scaling AR Operations Without Increasing Headcount

As businesses grow, invoice volume increases. Without automation, this growth often requires additional staff to manage billing and collections. AR modernization allows businesses to scale without proportional increases in headcount. Integrated payments, automated reminders, and real time reconciliation reduce manual workload and free finance teams to focus on higher value activities.

Payment API driven automation ensures that systems handle repetitive tasks reliably. POS systems, payment gateways, and accounting platforms work together to support growth without creating bottlenecks. This scalability is one of the most compelling reasons to modernize AR, especially for businesses planning expansion or increased transaction volume.

Preparing for the Future of Digital Receivables

The future of AR is fully digital, data driven, and customer centric. As payment preferences continue to evolve, businesses must be ready to adapt quickly. Modern AR systems built on integrated payments and flexible payment gateway infrastructure are well positioned to support new payment methods and regulatory changes.

Investing in payment API connectivity and adaptable POS systems ensures that AR processes remain future ready. Businesses that modernize now gain a competitive advantage by offering faster, more convenient payment experiences while maintaining operational control. AR modernization is not a one time upgrade but an ongoing strategy that supports long term resilience and growth.

Conclusion

AR modernization transforms accounts receivable from a slow, manual process into a streamlined digital operation. By moving from paper invoices to click to pay and ACH, businesses accelerate collections, improve cash flow, and enhance customer experience. Integrated payments provide the foundation for this transformation by connecting invoicing, payment acceptance, and accounting into a single workflow. With the right payment gateway, payment API connections, and supportive POS systems such as Clover POS and Genius POS, businesses can modernize AR without disrupting operations. In a competitive business environment, modern AR practices are not just about efficiency. They are about building a stronger, more responsive financial foundation for sustainable growth.