By Denise Calder December 15, 2025

Wholesale and manufacturing businesses operate in an environment where margins are closely monitored and transaction volumes are often high. Unlike retail, where transactions are smaller and more frequent, wholesale and manufacturing payments are usually invoice based, large in value, and tied to long standing client relationships. This makes payment efficiency more than a technical concern. It becomes a strategic priority. As digital payments have become the norm, many wholesalers and manufacturers are discovering that the way payments are processed has a direct impact on profitability. Level 3 processing, when implemented correctly, offers a real opportunity to reduce costs while maintaining operational clarity and compliance.

Level 3 savings are not about shortcuts or special treatment. They are based on transparency and data accuracy. Card networks reward businesses that provide detailed transaction information because it reduces risk and improves traceability. Wholesale and manufacturing businesses are naturally positioned to benefit because they already work with invoices, line items, tax breakdowns, and shipping data. The challenge lies in capturing and transmitting that data correctly through modern payment infrastructure. This is where integrated payments, the right payment gateway, and well configured payment API connections play a central role. With the right systems in place, Level 3 processing becomes a practical and repeatable strategy rather than a complex technical hurdle.

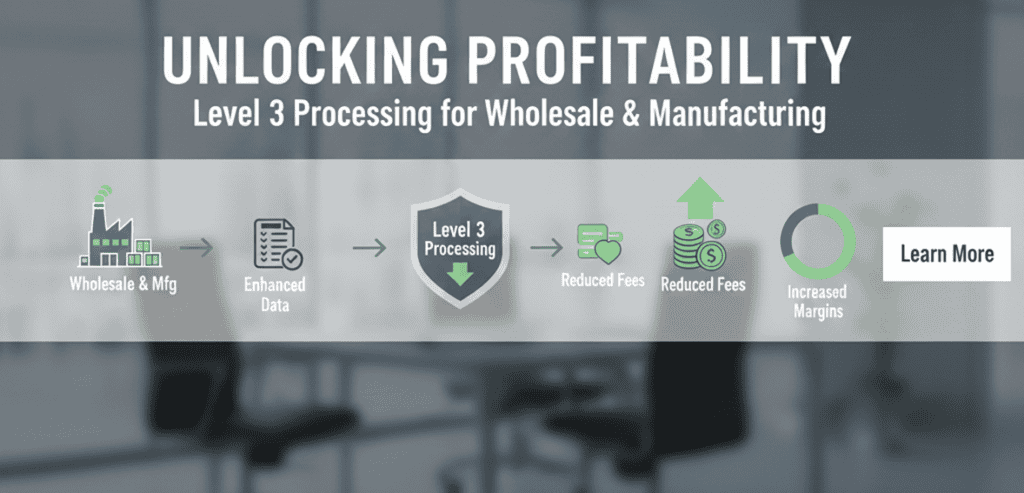

Why Level 3 Processing Matters for Wholesale and Manufacturing

Wholesale and manufacturing businesses often process fewer transactions than retail businesses, but the value of each transaction is significantly higher. This means that even small reductions in processing fees can translate into substantial annual savings. Level 3 processing was designed specifically for commercial transactions, particularly B2B and B2G payments, where detailed transaction data is readily available. By submitting enhanced data such as invoice numbers, tax amounts, product descriptions, quantities, and unit prices, merchants signal lower risk to card issuers, which leads to reduced interchange rates.

For wholesalers and manufacturers, Level 3 processing aligns naturally with existing workflows. Invoices already contain the required data, and accounting systems are structured around line item reporting. The challenge is not creating new data, but ensuring that the data flows correctly from invoicing systems through the payment gateway and into the card network. When this flow is properly configured, businesses can consistently qualify for lower interchange rates without changing how they sell or bill customers. Level 3 processing becomes a quiet but powerful contributor to margin improvement.

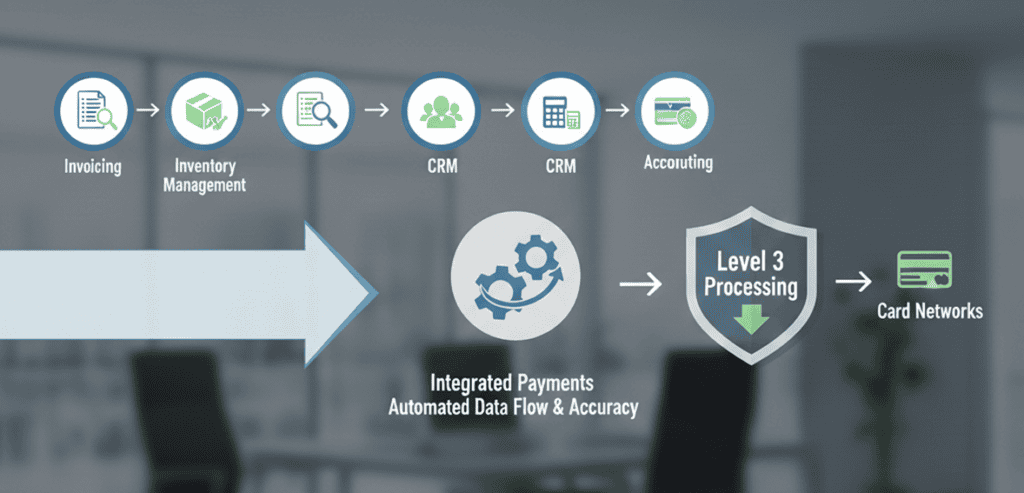

Understanding the Role of Integrated Payments in Level 3 Savings

Integrated payments are the foundation of successful Level 3 implementation. In a wholesale or manufacturing environment, payment processing cannot operate in isolation. It must connect seamlessly with invoicing, inventory management, accounting, and customer relationship systems. Integrated payments ensure that transaction data is captured once and reused across systems, reducing errors and manual entry while preserving data integrity.

When integrated payments are properly implemented, line item details from invoices flow directly into the payment process. This allows Level 3 data to be submitted automatically without requiring staff to re enter information at checkout. Automation reduces the risk of missing fields, which can cause transactions to downgrade to higher interchange categories. For businesses processing large volumes of B2B payments, integration is not just a convenience. It is a requirement for consistent Level 3 savings and long term operational efficiency.

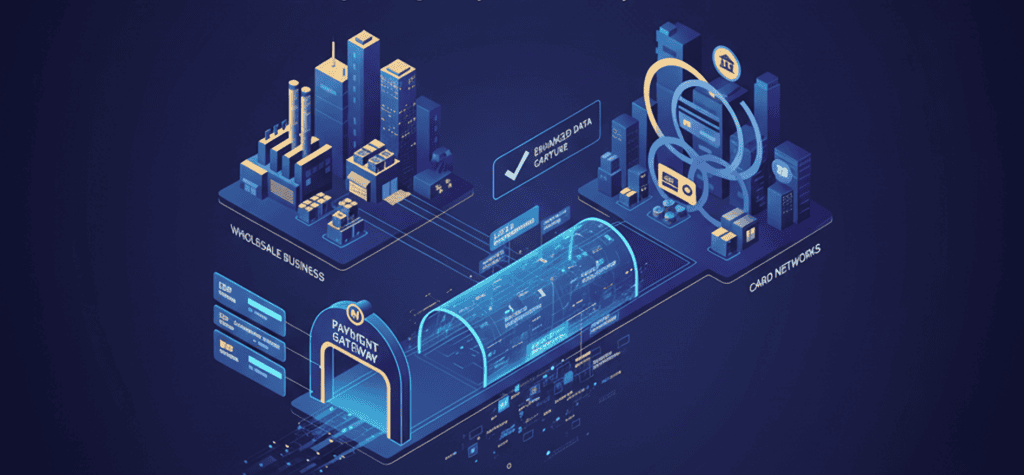

Choosing the Right Payment Gateway for Wholesale Transactions

The payment gateway acts as the bridge between a business’s internal systems and the card networks. For Level 3 processing, not all gateways are created equal. Many basic gateways support only standard consumer transactions and lack the ability to transmit enhanced data fields. Wholesale and manufacturing businesses must choose a payment gateway that explicitly supports Level 3 data requirements.

A strong payment gateway should be capable of accepting detailed line item data, tax breakdowns, shipping costs, and invoice references. It should also integrate smoothly with ERP and accounting systems commonly used in wholesale and manufacturing environments. Reliability and transparency are critical, as any data loss or formatting error can result in transaction downgrades. Selecting the right payment gateway is one of the most important decisions in a Level 3 savings strategy, as it determines whether enhanced data can be captured consistently and accurately.

How Payment API Connections Enable Automation and Accuracy

A payment API is the technical backbone that allows systems to communicate with each other. In wholesale and manufacturing environments, payment API connections enable automated data exchange between invoicing platforms, ERP systems, and the payment gateway. This automation is essential for Level 3 processing because it eliminates manual steps that often introduce errors or omissions.

With a properly configured payment API, transaction data is transmitted in real time during payment authorization. Product descriptions, quantities, unit prices, and tax amounts are passed automatically, ensuring that every eligible transaction meets Level 3 requirements. This reduces reliance on staff training and manual checks, which are difficult to maintain at scale. Payment API driven automation not only supports Level 3 savings but also improves overall efficiency, reduces reconciliation issues, and strengthens data accuracy across the business.

Aligning POS Systems With Wholesale and Manufacturing Workflows

While many wholesale and manufacturing businesses rely heavily on invoicing rather than point of sale transactions, POS systems still play a role in certain environments such as showrooms, trade counters, or hybrid operations. Modern POS systems must be capable of supporting enhanced data capture if they are used for Level 3 eligible transactions.

POS systems that integrate with backend systems can pass item level details directly into the payment process. This is particularly useful for manufacturers with onsite sales or wholesalers operating cash and carry models. When POS systems are aligned with accounting and inventory systems, they become an extension of the integrated payments ecosystem rather than a disconnected endpoint. Proper alignment ensures that Level 3 data is captured regardless of where or how the transaction originates.

Using Clover POS in Wholesale and Manufacturing Environments

Clover POS is often associated with retail and hospitality, but it can also support certain wholesale and manufacturing use cases when configured correctly. In environments where Clover POS is used alongside invoicing or ERP systems, integration becomes the key factor. Clover POS can serve as a front end for accepting payments while backend systems handle line item and invoice data.

To support Level 3 processing, Clover POS must be integrated with a payment gateway and payment API that can transmit enhanced data. This often requires custom configuration or third party integrations. When done correctly, Clover POS can function as part of an integrated payments strategy rather than a standalone retail tool. For businesses with mixed sales channels, this flexibility allows Clover POS to contribute to Level 3 savings instead of limiting them.

Leveraging Genius POS for Advanced Payment Data Capture

Genius POS is designed with integration and data capabilities in mind, making it a stronger fit for environments that require advanced transaction detail. In wholesale and manufacturing settings, Genius POS can support itemized transactions and integrate with backend systems that store invoice and product data. This makes it easier to meet Level 3 data requirements consistently.

By connecting Genius POS to a robust payment gateway and payment API, businesses can automate the submission of enhanced data fields during payment authorization. This reduces manual effort and improves qualification rates for lower interchange categories. Genius POS is particularly useful in environments where in person transactions coexist with invoicing and online payments, allowing all channels to feed into a unified Level 3 strategy.

Capturing the Right Data Without Disrupting Operations

One of the most common concerns about Level 3 processing is that it might slow down operations or create additional workload for staff. In practice, the opposite is true when systems are properly designed. The goal of a practical playbook is to embed Level 3 data capture into existing workflows rather than adding new steps.

By relying on integrated payments and automated data transfer through a payment API, businesses can ensure that required fields are captured as part of normal invoicing and order processing. Staff do not need to think about Level 3 requirements during each transaction because the system handles it in the background. This approach minimizes disruption while maximizing savings, making Level 3 processing sustainable over the long term.

Avoiding Downgrades Through Consistent Data Quality

Downgrades occur when a transaction fails to meet the required data standards for Level 3 processing. Even a single missing field can result in higher interchange fees. Consistency is therefore critical. Wholesale and manufacturing businesses must ensure that data formats, field mappings, and system integrations remain accurate over time.

Regular audits and monitoring help identify issues before they become costly. Merchant services providers and technology partners can assist by reviewing transaction logs and qualification reports. Maintaining consistent data quality is not a one time task but an ongoing responsibility. When managed correctly, it ensures that Level 3 savings are realized on every eligible transaction rather than sporadically.

Measuring the Financial Impact of Level 3 Savings

The true value of Level 3 processing becomes clear when businesses track its financial impact over time. Comparing effective processing rates before and after implementation often reveals meaningful cost reductions. For high volume wholesale and manufacturing operations, these savings can reach tens of thousands of dollars annually.

Beyond direct fee reductions, Level 3 processing also improves financial forecasting and budgeting. Predictable processing costs allow businesses to plan margins more accurately and price products with greater confidence. When combined with integrated payments and automated reporting, Level 3 savings become part of a broader financial optimization strategy rather than an isolated technical improvement.

Scaling Level 3 Processing as the Business Grows

As wholesale and manufacturing businesses grow, transaction volume and complexity increase. A well designed Level 3 processing setup scales naturally alongside growth. Because data capture is automated through integrated systems and payment API connections, higher transaction volumes do not increase administrative burden.

Scalability is one of the strongest arguments for investing in Level 3 capable infrastructure early. Businesses that wait until volume becomes unmanageable often face costly retrofits and operational disruption. By building Level 3 readiness into payment systems from the beginning, wholesalers and manufacturers position themselves for efficient and profitable growth without constant system overhauls.

Aligning Merchant Services With Long Term Strategy

Merchant services should support long term business goals rather than simply facilitate transactions. For wholesale and manufacturing businesses, this means choosing partners who understand B2B payments and Level 3 requirements. Transparent pricing, detailed reporting, and proactive optimization support are essential qualities in a merchant services provider.

A strong partner will help evaluate transaction eligibility, optimize data capture, and monitor performance over time. They will also ensure that integrated payments, the payment gateway, and payment API remain aligned as systems evolve. This strategic alignment turns payment processing from a cost center into a competitive advantage that supports growth and margin protection.

Conclusion

Level 3 processing offers wholesale and manufacturing businesses a practical and effective way to reduce payment processing costs through transparency and data accuracy. By leveraging integrated payments, selecting the right payment gateway, and implementing reliable payment API connections, businesses can automate enhanced data capture without disrupting operations. POS systems like Clover POS and Genius POS can play a supporting role when properly integrated into the broader payment ecosystem. With consistent data quality and ongoing monitoring, Level 3 savings become predictable and scalable. For wholesalers and manufacturers focused on efficiency, margin protection, and long term growth, Level 3 processing is not a technical upgrade. It is a strategic playbook for smarter payments and sustainable success.